How Your Income And Contributions Affect Your Housing Loan Entitlement

In case you are wondering how much loan amount you are entitled, this article intends to address that.By now, you should already know that the maximum housing loan amount Pag-IBIG can possibly grant to a member is P 3,000,000 while the smallest amount is only P 100,000. And the corresponding interest rate is actually shown at the Right Panel of this website.

Basically, there are two very important factors that affect the loan amount you will be entitled to:

- The amount of your contribution

- Your Net Disposable Income

These things are easier to understand with the following Tables.

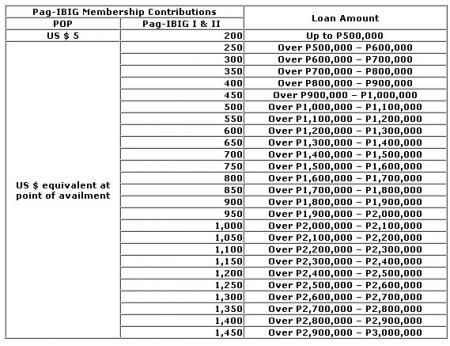

Loan Entitlement Based On Pag-IBIG Contribution

So looking at the table, if you need, for example, to get a loan amounting to P 2,000,000 your contribution should be P 950 / month. Now PhP 950 /month is easier for most Pag-IBIG Members. Quite frankly, there is no problem in that area.

Special Note to OFWs / POP Members: Since you are contributing in US Dollars, the table essentially means to need to contribute the US Dollar equivalent of that amount in Philippine Peso. As you know, there is a constant swinging of values between these two different currencies so there is also a corresponding adjustment.

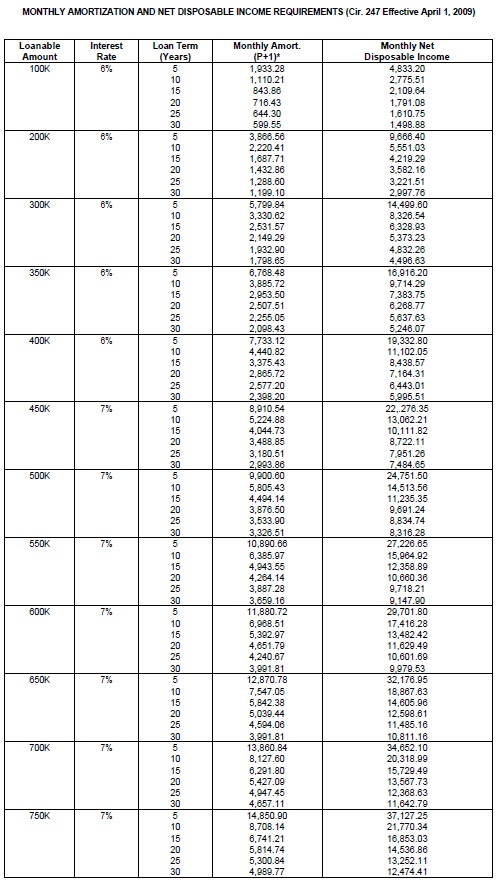

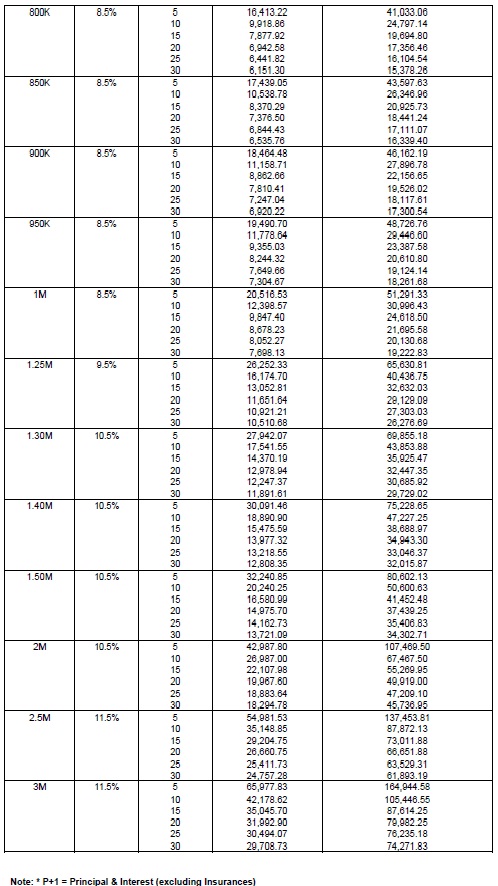

Loan Entitlement Based On The Capacity To Pay

Take note of this part and this is very important.According to the Pag-IBIG Fund Primer on Housing Loan, “A member’s loan entitlement shall be limited to an amount for which the monthly repayment on principal and interest shall not exceed 40% of the member’s net disposable income…”

In other words, the monthly amortization should be less than 40% of your net disposable income.

The following Table should guide you.

For example, if you are looking to get a PhP 1,000,000 loan and plan to pay it in 10 years (monthly amortization is P 12, 398.57 at 8.5% interest per annum), your net disposable income should be PhP 30,996.43 or higher (the higher the better).

So to avoid having problems paying for the property, that means you have to work backwards: Determine your net disposable income first, then buy a property based on the amount of loan that you can comfortable pay.

Let’s see if you really understand the Table shown above.

Question: You are planning to get a Pag-IBIG Housing Loan amounting to P 2,000,000 and pay it in 10 years. How much should your monthly income be?

Answer: Your monthly income should be P 67,467.50 or higher. And your monthly contribution should be P 950.

Additional Notes on Borrower’s Eligibility For Housing Loan

To be eligible for the housing loan, a member should:- Be a member for at least 24 months and has remitted at least 24 monthly contributions.

- Be 65 years old or younger at the time of loan application.

- Not be more than 70 years old at the maturity date of the loan.

- Have no outstanding housing loan from Pag-IBIG.

- Have no Multi-Purpose Loan in arrears at the time of housing loan application.

- Have no Pag-IBIG Housing Loan that was foreclosed, cancelled, bough back or subjected to dacion en pago.

5 Great Tips For The First Time Pag-IBIG Home Buyers

This article is intended for the first-time home buyer who wanted to buy a house using Pag-IBIG Financing.

Maybe you are still single and you already wanted to get a house before getting married. (Well, this was the route that I followed.) Or, maybe you are newly wed and you decided that you want to live separately from your parents. Believe me, there’s no substitute to the feeling that you are living on your own home.

A Pag-IBIG starter home — your first home — may not be the most impressive home in town. That’s okay. Forget about the Joneses. Like your puppy love, don’t ever think that it will become your dream home. Rather, treat it as a nest egg that allows you to slowly build your investment (hedge against inflation) while literally having a roof over your head.

Buying your first home through Pag-IBIG is so easy if you take note of the following tips offered here.

Tip #1: Work With Your Real Estate Professional

By real estate professional, in this context, I’m referring to the real estate broker or agent who is directly selling the house.

By real estate professional, in this context, I’m referring to the real estate broker or agent who is directly selling the house.

You may think that getting the assistance of a real estate agent will make the property more expensive. Whoever told you that must be very ignorant of the whole process.

Here’s what you should know: The real estate professional can’t change the selling price of the property that is owned by the Developer. That is, they can’t markup the price nor can they offer a discount. The selling price and discounts are completely dictated by the Developer’s Marketing Team and the agent can never, ever change that price.

Using a real estate professional right from the start saves you from a lot of headaches associated with the home purchase. For one, the guy is a good source of information such as the following:

- The project

- The property

- The financing schemes

- Special promotions and discounts

- The materials used,

- The move-in process

And if you are using Pag-IBIG Financing, your real estate agent should be able to help you cut through the bureaucracy in the Office.

Tip #2 : Buy A New House

Avoid foreclosure properties or properties that are for assume. Most of these properties are inherently problematic. You don’t want to find yourself catching someone else’s problem, do you?

Many foreclosed properties are so cheap you are tempted to jump on the deal immediately. Not so fast. This may be one of those cases where cheap could actually turn out to be very expensive.

As much as possible, make sure you are the first owner. Of course, as time goes, newer homes will become harder to find. If that’s the case, make sure that the Land Title is clean.

Tip #3 : Buy From A Legitimate Real Estate Developer

Never, ever deal with a fly-by-night real estate developer. But the crooks have a way of putting on the mask in such a way that you can’t detect the devil’s intentions. Here’s where common sense becomes a useful tool at your disposal.

At the very least, a legitimate Real Estate Developer:

- Has complete Business Permits and Licenses to operate in that line of business.

- Issues an Official Receipt from the Bureau of Internal Revenue.

Some good points to keep in mind:

- Check the track record of the Developer – especially its past projects.

- Make sure they are accredited by the Pag-IBIG Fund. (only if you intend to use Pag-IBIG Loan)

- Check the License To Sell and Development Permit – they should have both.

Tip #4 : Make Sure You Have Your Finances In Order

Here’s a handy checklist:

- You are currently an active Pag-IBIG member with at least 24 months contributions

- Your employment history is impressive

- You have enough salary/income to cover the monthly amortization

Related articles:

- The Pag-IBIG Housing Loan Process

- The Basics of Home Financing

- Improve Your Chances of Getting A Loan

Tip #5 : Save Enough For The Down Payment

The greatest hurdle most real estates buyer ever faced is coming up with the down payment. Many are surprised when they find they don’t have enough cash to cover the outright cash payment required of them.

The down payment, sometimes called equity, is usually 10% to 30% of the selling price. And almost always, it is to be paid one-time about one month after placing the Reservation Fee. So one of the first problems you should think about is the amount of cash you need to raise for the down payment.

Down Payment Tip: Ask your real estate agent if you can defer the payment of the down payment to, say, 12 months. This should be easier on your pocket.

Online Concerns: Housing Loan Applications, Membership Status And Contributions Inquiry, Etc.

Most visitors coming to this website are Overseas Filipino Workers based from different places abroad. And many of them are asking about the online facilities of the Pag-IBIG Fund (the official website is at http://www.pagibigfund.gov.ph) so they can do some transactions anywhere they are comfortable. Some of the most common questions we encounter are listed below.

- I want to become a member of the Pag-IBIG Fund. Can I do it online? Do you have an online form that I can fill up and send back to you?

- Can I apply for A Housing Loan Online?

- May I request for my Pag-IBIG ID Number? Please send it through email.

- How will I know about my past contributions?

- Can I send my payments (contributions/amortizations) online?

Of course these are valid concerns as legitimate members of the Pag-IBIG Fund.

In this article, we’ll address each of these questions.

#1. Membership Application: I want to become a member of the Pag-IBIG Fund. Can I do it online? Do you have an online form that I can fill up and send back to you?

Yes, this is possible. Simply download Member’s Data Form. Print two copies and send back to the Pag-IBIG Fund.

While doing that is very convenient, the good ole way of actually handing it to the office is still best way to do it. That way, you get someone to give you an acknowledgment that your form has been received.

The most ideal way of doing it should be to just fill-up and online form — as opposed to downloading it — and waiting for a verification via email. Unfortunately, this one doesn’t exist yet. So, let’s make the best use of this one.

See also:

- Voluntary Membership To The Pag-IBIG Fund.

- An Employee’s Guide To Pag-IBIG Fund Membership.

- Pag-IBIG Overseas Program

- Benefits of Becoming Pag-IBIG Fund Members.

#2. Online Loan Application: Can I apply for A Housing Loan Online?

Just like the new member’s concern stated in #1, applying for a housing loan online still involves downloading an application form. Actually, there are other forms available on the website that are related to Pag-IBIG Loans. Here is one that you can use for the Housing Loan

The best way you can do with that form is to first study it. That should give you an idea of the documents and financial information required of you. Of course, the application will only be honored once submit it together with your signature.

Related Links:

- Understanding the Basics of Pag-IBIG Housing Loan

- Pag-IBIG Home Loan Process

- Pag-IBIG Housing Loan Requirements

#3. About Pag-IBIG ID: May I request for my Pag-IBIG ID Number? Please send it through email.

Sorry, but you have to personally go to the office and request for your Pag-IBIG ID Number. Please refer to #4 on how to best approach this concern.

#4. Contributions: How will I know about my past contributions?

You may want to proceed to the nearest Pag-IBIG Office and approach the staff that you want to consolidate all your contributions. You will then be given a form that you need to fill up.

The result of this might take some time especially for those who are transferring from one employer to another or those who have changed their memberships, say from employee to self-employed.

Please be patient and follow-up your inquiry at the concerned Department from time to time.

Please be patient and follow-up your inquiry at the concerned Department from time to time.

Once you get the result, you should be able to view a list of your contributions and that of your past employers. Plus, take note, the document should bear your Pag-IBIG ID Number.

See also: Your Money In Pag-IBIG Fund.

#5. Online Payment: Can I send my payments (contributions/amortizations) online?

Unfortunately, this is not possible yet. The closest way to accomplish this is to open an account with a Philippine Bank that accepts Pag-IBIG Payments. You can then arrange with the bank to execute an auto-debit setup from your account to Pag-IBIG Fund to pay for your contributions or obligations.

The Pag-IBIG Multi-Purpose Loan

The other popular program is the Multi-Purpose Loan (MPL) or sometimes referred to as Personal Loan. The Pag-IBIG Multi-Purpose Loan is essentially a financial assistance to Pag-IBIG Member that they can use for any of the following purpose:

1. Minor Home Improvement – Take note that this is only for minor home improvements. For renovation works requiring larger amount of money, you may want to avail of the Housing Loan for Home Improvement.

2. Small Business / Livelihood Financing – Good news to those who run small businesses or those planning to have one. You may use the proceeds of this loan to finance your small business venture whether it is for expansion or for initial start-up capitalization.

3. Medical Assistance – If you find yourself in need of money for that medical bill, Pag-IBIG Multi-Purpose be of help.

4. Educational Purpose – You can even use it to finance your education.

5. Purchase of Appliances and Furniture – This refers to those toys that you have been wanting to buy.

6. Others – The list could go on. Actually, there can be many other things you can use that loan for.

Loan Amount, Interest Rate, Loan Term

Your loan entitlement depends on the number of contributions made and the Total Accumulated Value (TAV). Remember that TAV is defined as the member’s personal contributions, the corresponding contributions of his employer and the total dividend earnings.So, how much can you loan exactly? The list below serves as reference.

- 24 to 59 months contributions = Up to 60% of TAV

- 60 to 119 months contributions = Up to 70% of TAV

- 120 months contributions or more = Up to 80% of TAV

The one nice thing about the Pag-IBIG Multi-Purpose Loan is that the interest rate can be as little as 10.75% per annum. That’s one of the most competitive rates in the market you can find.

The loan is to be amortized over a period of 24 months.

Loan Payments and Penalty

Paying for the loan is easier for those who are employed: payments can be done through salary deduction.However, if you are voluntarily contributing, the following methods of payments are also available.

- Over the counter

- Auto-debit arrangement with accredited banks

How To Apply For Pag-IBIG Muti-Purpose Loan

1. Secure an MPL Application Form and checklist of requirements from any Pag-IBIG Fund Office.2. Accomplish and submit the Application Form together with the requirements at the servicing branch.

3. Wait for the Loan Approval based on the date reflected on the MPL Acknowledgement Receipt.

4. Claim your check with your valid ID and the MPL Acknowledgment Receipt.

Learn The 5Cs of Credit To Improve Your Chances Of Getting A Loan

How true! It simply means that as a lending institution, the bank will consider a number of factors before granting you a loan. Just because you need a loan doesn’t mean you will get it.

Well, more or less, the same can be said of Pag-IBIG Fund. Just because you are a member of Pag-IBIG doesn’t automatically mean that you will get a loan anytime you want to.

However, your chances of success will be greater once you are aware of the most important factors they are considering when you apply for a loan, whether personal loan or housing loan.

Remember these so called 5 Cs of Credit and see how you can apply it in your respective situations.

1. Character

What sort of person are you from the point of view of the Loan Officer? Are you someone who can be trusted with the loan? Are you most likely to pay it on time or are you the one who will most likely be a candidate of loan defaults?

How long have you been a member of the Pag-IBIG Fund? How long have you been in your work or profession? Your employment record is one of the factors they consider in the evaluation process.

See also: Getting a Pre-Qualification.

2. Capacity

How much is your salary or income? This will determine how much you can set aside to pay for the monthly amortization.

In general, the bigger the income, the better your chances of being approved. But don’t fool yourself. A lot of high-income professionals also maintain a high-maintenance lifestyle. But it all really boils down to how much is left before the next payroll takes it toll.

How much can you safely borrow? Pag-IBIG has a maximum limit of PhP 3M for the housing loan. Unfortunately, the maximum limit is not for everyone to enjoy. Your loan amount will most likely depend on your capacity to pay for it.

See also : Can You Afford That House?

3. Capital

This is another word for Equity or in some cases, it also refers to the down payment. How much of your own money do you put at risk? A large equity means you are serious about the venture that you are willing to expose that much for the property you are buying.

See also : Mortgage Loan Fundamentals

4. Conditions

What is the current state of the economy? If it is shaky, your loan application will also be drastically affected. Interest rate, which also determines the cost of using borrowed money, may also rise in response to a downturn in the economy.

What industry are you presently employed? Is it a booming industry?

How is your employment status? Are you likely to stay with your employment for the next 5 or 10 years?

5. Collateral

What are you willing to back up your loan with? In a housing loan, this one simply means the Land Title, which must be in the name of the borrower.

It only makes sense. With the collateral at stake, you will most likely meet your obligations on the loan than lose your collateral.

Your Money In Pag-IBIG Fund

How Your Money Enters The Pag-IBIG Fund

The moment you become a member of the Pag-IBIG Fund, that’s the first time your money enters into the Fund. For some, there is really no choice. All employees who are covered by SSS and GSIS are mandated and required to also contribute to the Pag-IBIG Fund. Others are voluntarily contributing to the Fund.What is a Mutual Fund?

It’s ironic, a lot of Pag-IBIG Fund members are not aware that the Pag-IBIG Fund is a Mutual Fund company, let alone know what a Mutual Fund is.If you are one of them, don’t despair, you have come to a place that can help you get educated on the intricacies of the Pag-IBIG Fund.

First things first. Pag-IBIG Fund is just a fancy term for Home Development Mutual Fund. That’s a handy term to help you remember it easily. Unfortunately, it also blinds you to a lot of other things about the company and what it does with your money.

Next, let’s talk about Mutual Fund. Let’s call on Investopedia.com to assist us on the definition of the term Mutual Fund:

“A mutual fund is nothing more than a collection of stocks and/or bonds. You can think of a mutual fund as a company that brings together a group of people and invests their money in stocks, bonds, and other securities. Each investor owns shares, which represent a portion of the holdings of the fund.”

That definition says a lot of things. In relation to Pag-IBIG Fund, it means that you and other members have come together to pool their money (called Fund) and invest it on something. That something is determined by the company, or the Mutual Fund manager. So essentially, as a member of the Pag-IBIG Fund, you are also an investor of the Fund.

Pag-IBIG Money As Savings: How Your Money Earns in Pag-IBIG Fund

Pag-IBIG says that you are saving money when you are contributing to the Pag-IBIG Fund.In a way, yes. You and your employer have combined to save in the Fund. But, unlike a regular bank savings that you have been accustomed to, your money has no fixed rate of return. That money is being invested and its earnings vary and depend a lot on so many factors. At the end of the year, your savings will earn an annual dividend which is also automatically credited to your total savings. The total savings is also referred to as Total Accumulated Value (TAV), and it includes your contributions, your employer’s contributions plus all the dividends it earns.

Provident Claims: How To Withdraw You Money

Now comes the itchy part: How do you withdraw your savings?(A lot of our OFW visitors are asking how to withdraw their contributions in Pag-IBIG since they are no longer active. We hope this article helps.)

You may be surprised, but your savings with Pag-IBIG is not as liquid as your regular bank deposit. In other words, to withdraw it, you have to wait… 20 years or so, that’s the maturity period of your money.

Here are the instances where you are allowed to withdraw your money in Pag-IBIG.

- The member has been contributing for 20 years and after having made a total of 240 contributions.

- Upon retirement (early retirement at age 45; optional retirement at age 60; mandatory retirement at age 65)

- Permanent departure from the country

- Total Physical disability or Insanity

- Termination from service for health reasons

- Death of the member (of course, your beneficiaries will be the one to claim it)

- For members who have registered under RA 7742 and RA 9679, you may withdraw your money after 10 years or 15 years of continuous membership.

Why This Question Is Wrong: “Can I Pay The Whole 24 Months Contribution One-Time So That I Can Avail of the Housing Loan?”

Yes, that’s a wrong question and later I will explain why.The main purpose of this article is simply to tell you not to ask that question from now on, because it’s a wrong question. Enough of that question. Period.

The Right Answer To The Wrong Question

We have received that kind of question several times and the answer has already been put at the FAQ Page of this website. You can go visit that page if you don’t want to read a lengthy explanation.But since you are already here, heck, let’s answer that.

Maybe someone already told you that you can pay the whole 24 months upon membership and right there and then apply for a housing loan. That used to be possible. But the management of Pag-IBIG Fund found out that it’s been abused many times with some members doing it just for the sake of getting a loan.

And so they fixed the loophole. A new rule was implemented and it is not anymore allowed do it. In other words, if you are a new Pag-IBIG Member, you really have to be actively contributing for a period of 24 months before you can begin applying for a housing loan.

So Why Is It A Wrong Question?

The very question itself shows that the person asking is in desperate need of a loan. Unfortunately, just because you are desperate need of a loan doesn’t mean you will get the money. As a matter of fact, the odds are against you if you display such a behavior.It’s a wrong question because:

- Pag-IBIG Fund Doesn’t Care If You Need A Loan.

- Pag-IBIG Fund Doesn’t Know You Yet.

- Pag-IBIG Fund Can’t Tell If You Have The Means To Pay For The Loan.

Reason #1: Pag-IBIG Fund Doesn’t Care If You Need A Loan.

One of the erroneous notions Pag-IBIG Members have is thinking that they are entitled to a loan. Unfornately, no. Just because you are a member of the Pag-IBIG Fund doesn’t mean you can apply for a loan any time and get the proceeds too.

Reason #2: Pag-IBIG Fund Doesn’t Know You Yet.

Most people who are asking such question are either not yet members or new Pag-IBIG Members. That means, these people have no proven records yet at Pag-IBIG. They are like strangers asking for a loan. They could be here now and gone the next day, who knows?

As a member, it is to your advantage if you maintain a clean, active and impressive record with Pag-IBIG Fund before you even attempt to apply for a loan. See to it that your records are updated and your contributions are up-to-date.

Reason #3: Pag-IBIG Fund Can’t Tell If You Have The Means To Pay For The Loan

Think about it. When you get loan, you are most likely to benefit from it and Pag-IBIG is taking a risk in granting you the loan. So to lessen the chances of making a mistake in granting the loan, and therefore losing money, Pag-IBIG has to make sure that they are giving it to the right guy — the one who has the means of paying the loan.

One of the ways Pag-IBIG checks for you are capable of paying the loan is by checking on your employment records such as employment history, contract of employment, salary, etc. So, before applying for a loan, see to it that your finances are in the right order.

This article is written by Carlos Velasco to help Pag-IBIG Fund Members understand the importance of the 24-month period of active membership to the Fund. The question is also among the most asked by the website visitors and with this article we at PagIBIGFinancing.com hope to make things clear for all Pag-IBIG Members.

The articles posted in this blog is created and written by Carlos Velasco.

CIRCULAR NO. 232

AMENDED GUIDELINES ON THE “MAGAANG PABAHAY, DISENTENG BUHAY”

PROGRAM

AMENDED GUIDELINES ON THE “MAGAANG PABAHAY, DISENTENG BUHAY”

PROGRAM

A. OBJECTIVE

In celebration of the National Shelter Month in October and in compliance with Memorandum Circular 112 of the President dated 7 September 2006, the Pag-IBIG Fund shall implement the “Magaang Pabahay, Disenteng Buhay” Program in order to achieve the following objectives:

1. To afford employees in the public sector as well as the other members of

the Fund the requirements of decent human settlement;

2. To provide such employees as well as members of the Fund with ample

opportunities to improve their quality of life;

3. To implement an affordable housing program for the government

employees as a form of non-wage benefit/incentive; and

4. To offer the Fund’s eligible acquired real estates for sale under reasonable terms and conditions consistent with those of the other shelter agencies and government financial institutions.

B. COVERAGE

1. These guidelines shall involve the disposition of all acquired real estates, including those that have not been auctioned off as well as properties that are occupied by the original borrower, tenant (under Ordinary Lease Scheme) or by any illegal occupant.

2. Likewise, properties covered by existing Contract of Lease with Option to Purchase under the Rent-to-Own Program may also be purchased by the lessee under the following conditions:

Updated monthly rental; and

Application of rental payments to the purchase price and corresponding

discount rate in the contract shall be dispensed with.

C. BASIC RULES

1. The first priority shall be given automatically to the occupants of the

acquired assets before disposing the same to new buyers.

2. The occupants of the acquired assets shall be notified and be given 15 days to formalize their offer. Otherwise, the Fund shall proceed with the processing of sale after the expiration of the 15 days notification to prospective buyers in order to prevent any disagreement between the two parties.

3. The spouse of the defaulted borrower shall be allowed to repurchase their units through cash or housing loan provided that the eligibility requirements under the existing housing loan guidelines are met.

4. Reservation Fee

The applicant/buyer shall be required to pay a non-refundable reservation fee of P1,000.00 subject to a 15-day reservation/compliance period. The said reservation fee shall form part of the processing fee in case the property is purchased through housing loan.

This requirement, however, shall not apply to the lessee of the property covered under the Rent-to-Own Program who intends to purchase said property inasmuch as the said lessee has the option to purchase the same within the 5-year period as provided for in the Contract of Lease with Option to Purchase.

5. Selling Price

The selling price of the property for sale shall be based on the latest appraised value, which shall not be more than two (2) years old as of the date of sale. However, the selling price of the property of an existing Rent-to-Own account shall be based on the purchase price stipulated in the Contract of Lease with Option to Purchase, which is equal to the appraised value of the property as of the date of the execution of the said contract.

6. Mode of Payment

6.1 Cash Purchase

a. Under cash purchase, the selling price shall be net of twenty percent (20%) discount plus five percent (5%) litigation discount, if applicable. The buyer or offeror shall only be entitled to the five percent (5%) litigation discount under the following circumstances:

the acquired asset has been unlawfully occupied prior to sale

negotiation between the buyer and the Fund; and

a Notice to Vacate has been sent to the illegal occupant of the

property.

In cases, where the Fund has already incurred expenses in the eviction of illegal occupants of acquired assets, the litigation discount may still be availed of net of the Fund’s expenses.

b. The buyer or offeror shall be required to deposit an amount equivalent to

at least five percent (5%) of the selling price, which shall either be in

cash or manager’s check, upon submission of the Purchase Offer form. The full payment of the selling price shall be made within thirty (30) calendar days from receipt of Notice of Approval of Sale. Withdrawal of an offer already accepted shall mean forfeiture of the fifty percent (50%) of the deposit in favor of the Fund.

c. The buyer who fails to pay the additional ninety five percent (95%) of the

selling price within the specified period shall lose his/her right to

purchase. Accordingly, the initial five percent (5%) payment of the selling

price shall be forfeited in favor of the Fund.

6.2 Purchase through Availment of Housing Loan

The buyer may avail a Pag-IBIG housing loan to acquire the subject property provided that the eligibility requirements under the existing housing loan guidelines are met. The selling price shall be net of fifteen percent (15%) discount plus five percent (5%) litigation discount, if applicable (refer to C.6.1.a hereof).

b. The buyer or offeror shall be required to deposit an amount equivalent to

at least five percent (5%) of the selling price, which shall either be in

cash or manager’s check, upon submission of the Purchase Offer form. For settlement of the full payment, the buyer or offeror shall be required to submit the loan documents to the Fund within thirty (30) days from the date of receipt of the Notice of Award/Notice of Approval of Sale.

Relative to the loan entitlement of the member-borrower, all provisions under the existing housing loan guidelines shall be complied with excluding, however, the loan-to-collateral ratio requirement. In this regard, loans up to P750,000 shall be subject to a

loan-to-collateral ratio of one hundred percent (100%) while loans over P750,000 up to P2.0 million shall be subject to a loan-to-collateral ratio of ninety percent (90%).

For purposes of evaluating the loan entitlement of the member- borrower based on capacity to pay, the gross family income shall pertain to the income of the borrower and the income of two other members of the family who are related within the third (3rd) degree of consanguinity or affinity (instead of 1st degree), provided that they are also Pag-IBIG Fund members and shall be considered as co- borrowers.

c. The buyer-borrower shall pay a processing fee of Three Thousand Pesos

(P3,000.00), inclusive of the One Thousand Pesos (P1,000.00)

reservation fee, as follows:

One Thousand Pesos (P1,000.00) uponreservation, which shall be

non-refundable if the loan application is disapproved; and

Two Thousand Pesos (P2,000.00).

d. The buyer-borrower shall be required to pay within thirty (30) days from

date of receipt of the Notice of Loan Approval the following:

Equity requirement (due to difference in the selling price and loanable

amount);

One-year payment of insurance premiums (SRI and Fire); and

Two Thousand Pesos (P2,000.00) processing fee.

e. Regardless of the economic value of the property, the remaining balance shall be paid in equal monthly amortization in such amounts as may fully cover the principal and interest, as well as insurance premiums, over a maximum period of thirty (30) years and shall in no case exceed

the difference between the present age and age seventy (70) of the principal borrower, with an annual interest rate of six percent (6%), if payment is made on or before due date and eight percent (8%), if payment is made after due date. The foregoing interest shall be applicable to all loans availed under this program.

f. The member-borrower shall be compulsorily covered by

Sales/Mortgage Redemption Insurance (SRI/MRI) and fire insurance, in accordance with the existing housing loan guidelines, except the provision on interim coverage.

g. Contract-to-Sell documentation shall be adopted with a required two-year seasoning period. Expenses to be incurred in the conversion of Contract- to-Sell to Real Estate Mortgage, broken down as follows, shall be paid together with the monthly payment within the first eighteen (18) months of the seasoning period, without interest:

Selling Price

Up to P2M

BIR

2.0%

RD

1.5%

LGU

1.0%

4.5%

The Expanded Withholding Tax (EWT) shall be for the account of the Fund. Upon default of the account and subsequent cancellation of the Contract-to-Sell (CTS), any amount paid for the conversion cost shall be refunded to the borrower

h. The loan shall be paid, whenever feasible, through salary deduction.

i. A borrower’s monthly payment shall thus be applied according to the

following order of priority:

Conversion cost

Upgraded membership contribution

Insurance premiums

Interest

Princip al

Upgraded membership contribution

Insurance premiums

Interest

Princip al

Any underpayment shall be subject to higher interest rate. In which case, the subsequent payment shall cover the unpaid portion of the previous monthly payment including the higher interest charged, plus the regular payment due for the month.

j. All other applicable provisions of the prevailing Guidelines of the Pag-IBIG

Housing Loan Program are hereby incorporated for reference.

7.Limitations

7.1 Acquired properties may be repurchased by former owners but only through cash basis. Such purchase shall only be subjected to the twenty percent (20%) discount rate but not to the litigation discount of five percent (5%) of the selling price.

7.2 For purposes of transparency and fair play and in order to prevent fraud and incidents that might be construed as violative of the Anti-Graft Law, employees and officers of Pag-IBIG Fund as well as its authorized agents/agencies who are directly involved in the administration, appraisal and/or disposition of acquired assets, are prohibited from participating and/or buying the acquired assets of the Fund under this disposal scheme.

This disqualification shall also cover individuals related to the abovementioned officers and employees within the first civil degree of consanguinity or affinity.

8.Documentation and Taxes

The Fund shall shoulder the expanded withholding tax, while the buyer shall pay all the applicable taxes, fees and assessments, such as but not limited to documentary stamp tax, transfer tax, registration fees, real estate taxes and all other expenses incidental to the sale.

8.1 Upon full payment of the selling price under cash purchase the following

documents shall be released to the buyer:

a. Title in the name of Pag-IBIG Fund:

Title

Deed of Absolute Sale (DOAS)

Tax Declaration

Tax Receipts

Deed of Absolute Sale (DOAS)

Tax Declaration

Tax Receipts

b. Title in the name of the Developer:

Title

DOAS

Deed of Assignment (DOA), with Special Power of Attorney (SPA, if

DOAS

Deed of Assignment (DOA), with Special Power of Attorney (SPA, if

applicable)

Tax Declaration

Tax Receipts

8.2 For properties purchased through housing loan, the Fund shall begin converting the eligible CTS to Real Estate Mortgage (REM) on the 18th month from date of take-out. After all the applicable taxes are paid with the Bureau of Internal Revenue (BIR), the Acquired Assets Department/Section shall process the transfer of title to buyer-borrower’s name as well as the annotation of the Loan Mortgage Agreement (LMA) in favor of the Fund with the Registry of Deeds (RD). The photocopies of the following documents shall be released to the buyer-borrower after the title has been transferred in his/her name:

Title

DOAS

Tax Declaration

Tax Receipts

DOAS

Tax Declaration

Tax Receipts

9.Other Provisions

9.1 Unsettled utility bills (water, power, etc) on properties disposed of on an

“As-Is-Where-Is” basis shall be for the account of the buyers.

9.2 For property under existing Ordinary Lease Contract, the Fund shall notify the lessee occupying said property, upon receipt of the required ten percent (10%) down payment from the buyer, to vacate the leased premises within one (1) month from receipt of the notice.